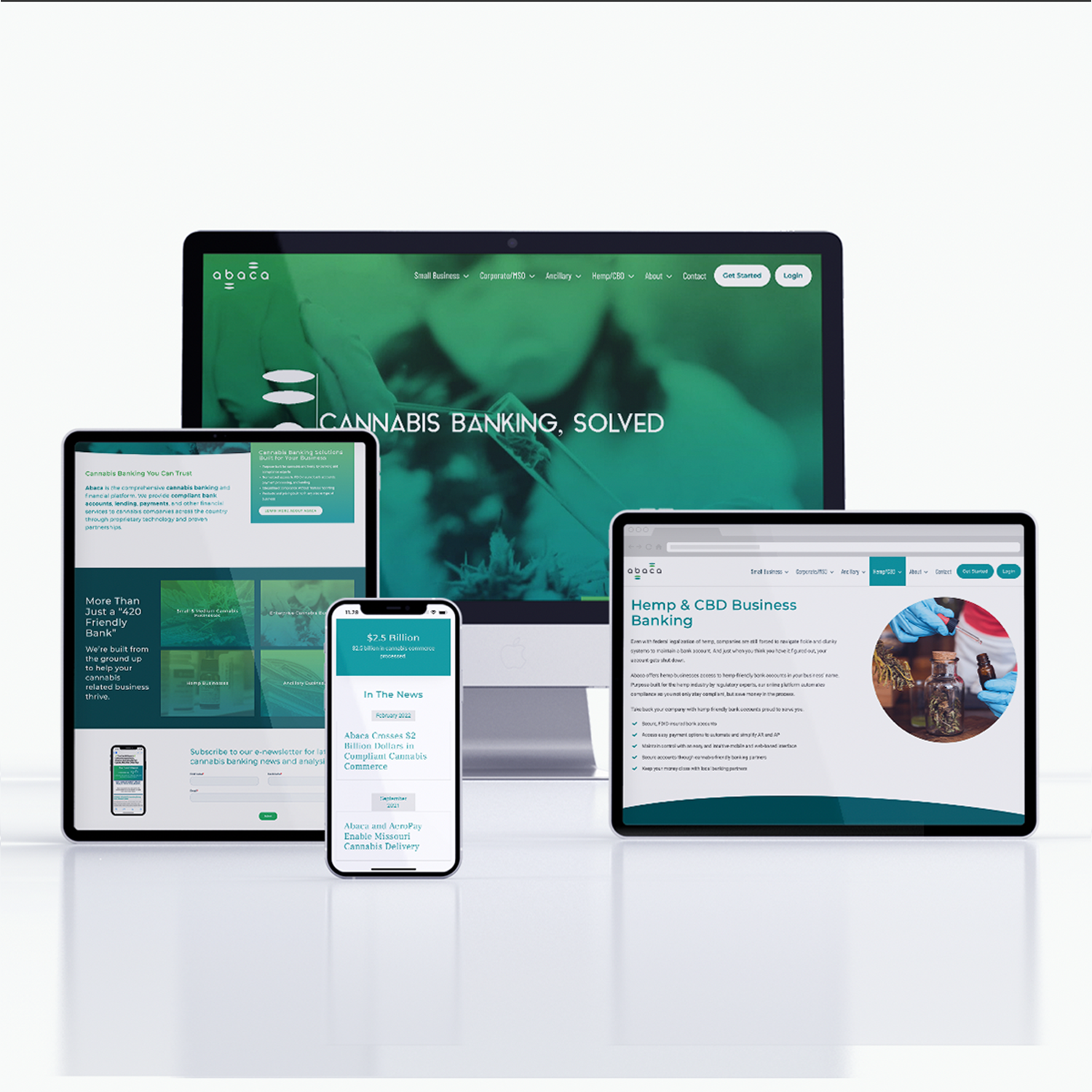

Creating a dynamic new brand for a cannabis fintech startup

The Challenge

Founded as MediPays in 2017, Abaca’s leadership team had its sights set on nationwide expansion. With that goal, Abaca charged Bud Agency with the challenge of concepting and developing a new brand.

Bud’s Solution

To develop the new identity, Bud focused on themes, metaphors and attributes that would resonate with the B2B prospects the company sought to engage, AND that accurately connoted the philosophy and products represented by the brand.

The problem really represented the principles of great identity in a nutshell: poor brand names are descriptive and limiting in nature: MediPays, National Hemp Co., CBD Solutions and the like. Such names constrict the focus and the future of the brand. Great brand names are connotative and evocative; in the most extreme cases they are nonsense or made up words: Google, Lexus, Acura. The middle ground is evocative and connotative words that reference the business but don’t describe it: Leafly, Leafwire come to mind.

Bud’s process is to explore creative solutions across multiple dimensions and themes. These creative explorations focus the minds of the agency and the clients and serve to provide guidance and direction for future exploration and refinement. Bud focused on themes including aviation, mountains, capital and “connotations.” We developed prospective names under each theme with clever meanings and memorable sounds.

Abaca, as it turns out, hit all the right notes. It is the name of a native Indonesian hemp strain; it is mildly connotative of “abacus,” the ancient calculating machine; it had a wonderful mouthfeel (to borrow a phrase from cookery); and it was in other ways a blank slate ready for us to invest meaning into.

Once our client’s leadership settled on the Abaca name, Bud designed the logo, tagline lockup, identity standards and brand playbook (master guidance on voice, tone, personality, visual brand and more) and refined it with input from stakeholders inside and outside the company.

Results

Following its rebrand, Abaca closed its first round of funding and expanded from servicing three to nine states. By mid-2022, Abaca had processed more than $2.5 billion (yes, Billion) in compliant cannabis transactions; its accelerating transaction volume was roughly 5% of the U.S. cannabis economy. Subsequently, Abaca closed its series A financing in anticipation of rolling out its services nationwide.